The practice of abusive tax avoidance—often characterized by aggressive tax planning that exploits legal loopholes in defiance of the spirit of tax law—poses one of the most significant modern challenges to stable governance and equitable societies. While legally distinct from outright tax evasion, its intent and impact are equally destructive, leading to profound and interrelated social and economic consequences. By draining public treasuries, distorting markets, and eroding institutional trust, abusive tax avoidance undermines the very foundations of the social contract.

The primary and most direct consequence of abusive tax avoidance is a massive economic deficit in public revenue. When large corporations and high-net-worth individuals shift profits to offshore tax havens or engage in complex, non-commercial financial schemes, sovereign governments are deprived of the essential capital required to function. This lost revenue directly impairs fiscal stability, forcing governments to choose between three detrimental options: increase the tax burden on compliant middle-class taxpayers and small businesses, cut spending on vital public services, or resort to increased public borrowing. For developing economies, this effect is often catastrophic, as the revenue leakage can easily dwarf the foreign aid they receive, perpetually trapping them in a cycle of fiscal dependence and underdevelopment. Furthermore, tax avoidance distorts market competition, giving an unfair advantage to large multinational entities that can afford the sophisticated legal and accounting services necessary to implement complex avoidance strategies, thereby punishing smaller, compliant domestic competitors.

The financial hemorrhaging caused by avoidance schemes rapidly translates into acute social harm and exacerbates inequality. Public services such as education, healthcare, and critical infrastructure are the first areas to suffer from reduced government budgets. When tax dollars that should fund schools, hospitals, and roads disappear offshore, the quality of life for the general population declines. This creates a severe equity issue, as the burden of revenue loss is effectively borne by those who rely most heavily on public services. Furthermore, the public perception of the wealthy and powerful systematically avoiding their fair share erodes confidence in the fairness and effectiveness of the democratic and legal systems. This deficit in institutional trust can lead to widespread social discontent, lower overall tax compliance rates among ordinary citizens, and foster an environment where corruption is more easily tolerated.

On a systemic level, abusive tax avoidance undermines global economic stability and justice. The use of tax havens and opaque cross-border structures facilitates illicit financial flows, money laundering, and corruption, making it harder for international regulatory bodies to maintain transparency and stability in financial markets. Strategies like “treaty shopping,” where entities exploit bilateral tax agreements in ways not originally intended, create a competitive race-to-the-bottom among nations. States, eager to attract investment, often lower their corporate tax rates or offer overly generous incentives, inadvertently sacrificing essential revenue and shifting the tax base away from genuine economic activity. Ultimately, abusive tax avoidance fractures the solidarity necessary for international cooperation, concentrating wealth and political power in the hands of the few and diminishing the capacity of sovereign states to achieve critical social development goals. Curtailing this practice is therefore not merely a technical fiscal challenge but a moral imperative for achieving global equity and sustainable economic order.

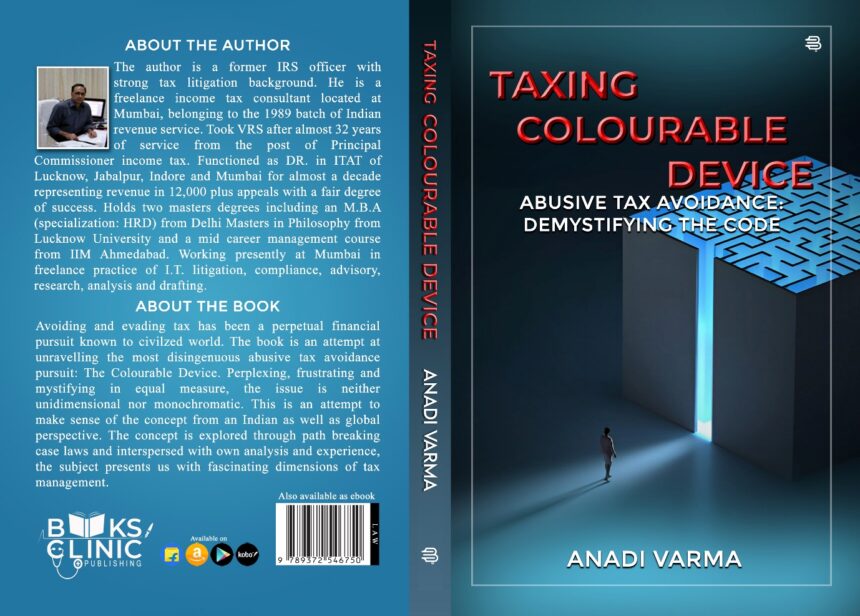

The book ‘’Taxing Colourable Device’’ by a former Indian Revenue Service officer Anadi Varma ,circumnavigates this complex web from an Indian perspective and intersperses the same with the trend in global tax systems.It is of immense use to govt tax agencies,tax law professionals ,taxadvisors and law colleges .Its the latest and most threatening tax challenge which is decoded by the author.

0

0 0

0