ETFs are gaining rapid popularity in India, offering easy access to diversified investments across stocks, bonds, and global assets. While many brokers promote “zero brokerage” ETF investing, the reality often includes hidden charges or platform restrictions. Investors must look beyond headlines to understand actual costs. In this blog, we compare leading brokers and uncover who truly delivers zero-cost ETF investing—transparently, consistently, and without compromise.

Types of ETF Investing Charges

Before diving in, it’s helpful to understand what is ETF. An Exchange Traded Fund (ETF) is a type of investment fund that is traded on stock exchanges, just like individual stocks. It holds a collection of assets—such as stocks, bonds, or commodities—and is designed to track the performance of a specific index, sector, or market. This allows investors to buy a single ETF and get exposure to a wide range of assets.

ETF investing comes with three key costs:

- Brokerage Fees: Fees paid to the broker when you buy or sell an ETF; applies per transaction and may vary across platforms depending on their pricing structure.

- Statutory Charges: Mandatory government charges like SEBI fees, stamp duty, exchange fees, and DP charges; these apply uniformly to all ETF transactions across all brokers.

- Platform Fees: Charges may include annual maintenance fees, subscription costs, platform usage fees, and charges for advanced tools or features offered within certain broker plans.

Before committing to a platform, investors can use an ETF SIP calculator to estimate total costs and potential returns over time. This helps in understanding how charges impact the overall growth of ETF investments, especially when planning long-term SIPs.

Understanding Zero-Cost ETF Investing

Zero-cost ETF investing means no brokerage fees on buying or selling ETFs, allowing your full investment to work in the market. This small saving can add up over time, boosting long-term returns. It’s also a great way for beginners to start without worrying about upfront costs.

However, not all “zero-cost” claims are the same. Some brokers waive fees only on ETF buys or under specific plans, while others may still charge during selling. That’s why it’s essential to compare platforms—brokerage, hidden charges, and overall value—to find the one that truly supports your goals.

1. HDFC SKY

HDFC SKY is a modern ETF app by HDFC Securities, designed for investors who value simplicity, transparency, and low-cost ETF investing. It offers ₹0 brokerage on both ETF delivery and intraday trades, making it a true zero-cost solution for lifetime. Further, investors who follow market trends, including updates like the reliance share price, can use the platform to track movements with ease

- Free account opening

- ₹0 Brokerage on ETF for lifetime

- ₹0 AMC for the first year

- Curated ETF baskets for diversified exposure

- Real-time tracking and easy order execution

2. Zerodha

Zerodha is India’s largest discount broker, offering a balance of advanced tools and competitive pricing for ETF investors.

- ₹0 brokerage on ETF delivery trades

- ₹20 or 0.03% per order on intraday ETF trades

- Free account opening

- AMC depends on the account type

- Offers live charts and simple ETF order placement.

- Let’s users invest in ETFs and mutual funds together.

3. Upstox

Upstox is a tech-friendly brokerage platform that caters to both beginner and active traders, offering affordable ETF access.

- ₹0 brokerage on ETF delivery trades

- ₹20 or 0.1% per intraday ETF trade, whichever is lower

- Free account opening

- AMC may apply based on the plan or usage after the promotional period

- Features an intuitive mobile app with smart alerts and basic research tools

4. Groww

Groww is an app-based investment platform focused on simplicity for first-time investors interested in ETFs, mutual funds, and stocks.

- ₹20 or 0.1% per ETF delivery and intraday order (min ₹2)

- Free account opening

- ₹0 AMC charges

- Clean user interface with minimal trading jargon

- Limited but accessible ETF options for basic investment goals

5. Angel One

Angel One is a full-service broker offering both self-directed and advisory-based investing, including ETFs.

- ₹0 ETF brokerage for trades ≤₹500 in first 30 days

- Post 30 days: ₹20 or 0.1% (delivery), ₹20 or 0.03% (intraday), whichever is lower

- Free account opening

- AMC structure based on account type

- Offers both self-directed and advisory-based ETF investing, letting you choose how hands-on you want to be.

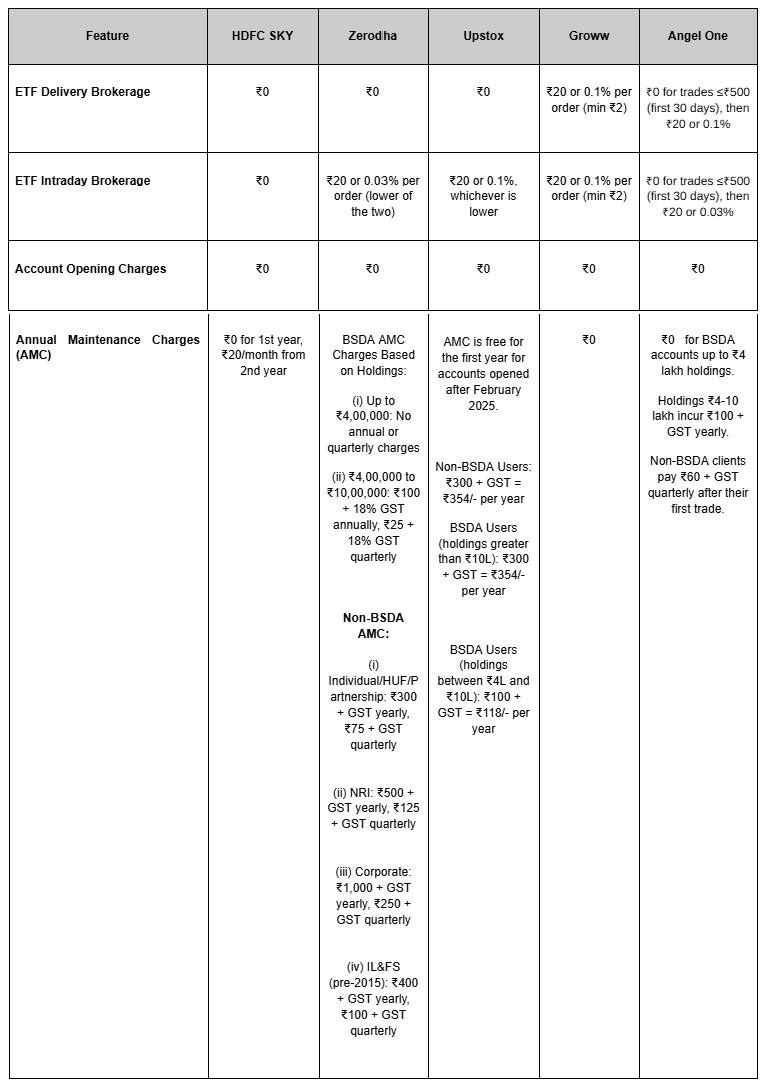

Comparison Table: ETF Investing Charges Across Popular Brokers

Among all platforms compared, HDFC SKY clearly leads the way with consistent ₹0 brokerage on both ETF delivery and intraday trades. It combines cost-efficiency with smart features like thematic ETF baskets, real-time tracking, and an intuitive interface. With no account opening charges and zero AMC in the first year, it’s designed for investors who value simplicity and transparency. This platform truly delivers on the promise of zero-cost ETF investing—without conditional pricing or hidden fees.

Conclusion

Zero-cost ETF investing sounds simple, but not all platforms deliver on this promise equally. When comparing brokers, it’s important to evaluate overall costs, including brokerage, AMC, and usability, rather than just relying on promotional claims.

One platform quietly delivering on all fronts is HDFC SKY, blending zero brokerage with easy tools and clear pricing—ideal for cost-conscious ETF investors.

0

0 0

0